Trading Empowered By Smart Tools

SOCBASE’s indicators include powerful strategies like ColorTrend, Master Delta Volume, Market Structure, Price Action, and Divergence, providing traders with comprehensive and advanced trading capabilities.

SocLevel Indicator

SocLevel automatically identifies 9 key levels for day trading as strong support and resistance. Best used with ColorTrend, it visualizes divergence, reversal candles, and overbought/oversold zones with cloud analysis. High-accuracy Top and Bottom signals make it essential.

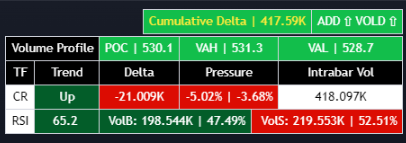

Session Volume Profile

SOCBASE’s Session Volume Profile (SVP) highlights past and present buildup zones, making key levels like VAL, VAH, and POC easy to identify. It simplifies spotting consolidation zones and important price levels better than other SVPs.

Master Delta Volume

Master Delta Volume is an advanced orderflow and Volume Footprint tool using sophisticated algorithms. Paired with ColorTrend, SocTrend, Volume Profile, it confirms trade entries by highlighting key buy/sell volume concentrations for precise execution.

SocTrend

SocTrend leverages Heikin Ashi, RSI, and Volume to analyze market trends and buying/selling strength across time frames. Key benefits are outlined below.

Rhythm – Market Internal

Rhythm is a precision support indicator for scalping and day trading SPY, SPX, and ES. Optimized for 1- to 10-minute charts, it helps traders enter safely and hold through market swings.